Mortgage loan calculatorDown payment calculatorHow Considerably household am i able to afford calculatorClosing expenditures calculatorCost of dwelling calculatorMortgage amortization calculatorRefinance calculator

Should the phrases the organization is offering you aren’t towards your liking, feel free to search elsewhere and don't forget - you happen to be the customer, they’re on the lookout for your online business, and so are prone to try to satisfy you in the center.

Shop around for any reduce fascination amount. Diverse lenders supply various interest charges. A decrease price equals a lower month-to-month house loan payment.

To compute your DTI ratio, divide your ongoing every month personal debt payments by your month to month income. For a standard rule, to qualify for a mortgage, your DTI ratio must not exceed 36% of one's gross every month profits.

The loan-to-price ratio (or. LTV) is an element looked at by lenders when qualifying a borrower for any mortgage loan loan. The LTV compares the amount of a loan to the worth with the asset being financed: the amount you are borrowing divided by the cost of the home staying procured or financed.

Your account is now obtainable for viewing on our new portal. We find the additional reporting capabilities and navigation features convenient to use.

You need to use a private loan to realize a good deal of different ambitions! Whether you wish to repay high-curiosity financial debt, finance a home enhancement project, create a prolonged-awaited obtain, or something else completely, a personal loan can assist you make it transpire.

BestMoney actions person engagement depending on the quantity of clicks Just about every outlined model acquired previously seven days. The volume of clicks to every brand is going to be calculated against other brand names mentioned in exactly the same query.

For borrowers website devoid of collateral that have below perfect credit history, these can be quite a great option, Regardless of the origination expenses and often substantial interest fees.

Almost all of the finest lenders enable cosigner loan. Come across a person that allows co signers using your amount of credit rating, and obtain an concept of what sort of service fees or other terms they need, then try to look for a cosigner.

If the individual includes a spotless financial report, it could really make it easier to obtain a loan with excellent conditions. Having said that, you should keep in mind that for those who default, it will also impact the money document of the cosigner. Ensure that it’s somebody who won’t hold this above you, and who you could function with to pay off the credit card debt.

Real, funds and family members don’t constantly mix, but from time to time You will need to depend on the folks near to you for assistance. Your cosigner will have to be an individual with better credit score than you, but will also ideally, with some fantastic collateral To place up.

A home finance loan price is the rate of fascination billed on a home finance loan. The lender decides the mortgage amount. They can be either mounted, keeping a similar for your mortgage phrase or variable, fluctuating that has a reference desire rate.

In the event the proof exhibits they did, the Division might go after appropriate cures to implement All those procedures.

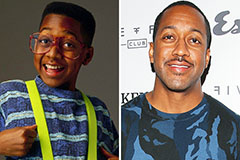

Jaleel White Then & Now!

Jaleel White Then & Now! Brandy Then & Now!

Brandy Then & Now! Marla Sokoloff Then & Now!

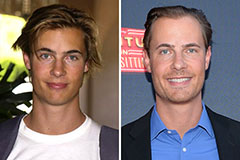

Marla Sokoloff Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now!